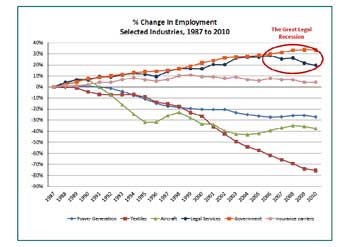

To put it straight, the current scenario is an indication of a great legal recession that already exists, as most legal pundits will agree. To put it straight (as fig. 1 explains), the legal industry in the United States is losing its capacity to employ more and more people. Perhaps the law firms in the United States are fast losing their charm as preferred employers.

The fact remains that lawyers will need to adjust to post recession changes in the $100 billion global legal industry. Since 2008, the financial downturn has forced law firms to cut down on lawyer hiring and provide discounts on their services. According to a recent study, the changes that have affected law firms since this period could well become permanent. The raw truth that is facing law firms is fierce competition along with outsourcing. This has indeed shrunk equity partner ranks as well as increased the commoditization of the more routine legal services. The sad reality is that law firms will have to adjust to post recession changes in order to remain competitive in the present market conditions.

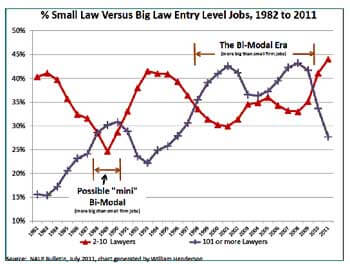

The changes that the law firms are facing are also affecting the entry level salary distribution. Presently, the entry level market is bi-modal. However, ideally, this should not be the case. Nevertheless, this has taken place, as fig. 2 indicates. The recent times have indicated the presence of a bi-modal era. Previously it could be safely assumed that legal ability would be normally distributed, and could not be bimodal.

Modern trends have proved the traditional line of thinking was flawed. This trend has become even more skewed with the emergence of outsourcing of legal work. Also, e-discovery vendors have taken a large slice of the pie that was meant for entry-level lawyers. Frankly speaking, the micro-level logic of hiring entry level lawyers from elite law schools tinkered with the ground reality that has brought the volume of BigLaw hiring to a near standstill.

Modern trends have proved the traditional line of thinking was flawed. This trend has become even more skewed with the emergence of outsourcing of legal work. Also, e-discovery vendors have taken a large slice of the pie that was meant for entry-level lawyers. Frankly speaking, the micro-level logic of hiring entry level lawyers from elite law schools tinkered with the ground reality that has brought the volume of BigLaw hiring to a near standstill.There is even more trouble for the law firms as the revenues per lawyer at AmLaw 100 firms has gone flat and has moved sideways since 2007 as fig. 3 shows. Unfortunately, this has broken a pattern of steady growth that dates back to pre-AmLaw 100 days.

There are more worries for law firm managers due to stagnant revenue. There are no higher profits to distribute – and that might cause the bigger partners who are the biggest producers to leave.

There are more worries for law firm managers due to stagnant revenue. There are no higher profits to distribute – and that might cause the bigger partners who are the biggest producers to leave.Today, the dominant strategy has got nothing to do with entry level hiring due to the usual profitability formula. The goal today has shifted to hiring lateral partners with portable business books. Senior lawyers are plentiful, and that is not worrying law firms in the least. However, this strategy is going to become redundant as more lawyers near retirement age. The entire scenario is going to have an effect on the legal education scenario in the country.

The situation therefore demands that law firms need to bring down the price of entry level talent to a point where they can be cost effective for training and further employment. Currently, the salaries for entry level lawyers are $160,000, which still persists because most law firms do not want to reduce this for the fear of being labeled second rate. This is not a precise or innovative business strategy.

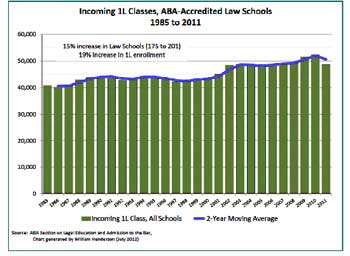

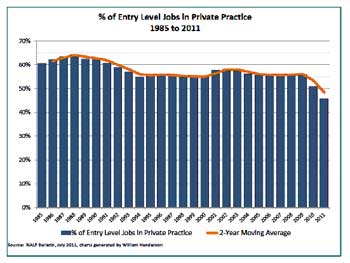

The scenario today is further compounded by stark contrasts. Upon examining fig. 4 and fig. 5 side by side, it is easy to come to the conclusion that though law schools have witnessed an increase in enrollment

(15% increase in Law Schools (175 to 201) 19% increases in 1L enrollment), the % of entry level jobs in private practice has fallen below the 50% mark.

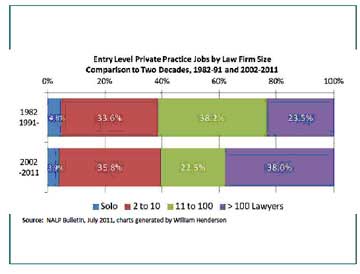

There are more indicators to the falling employment opportunities for entry level law graduates. According to fig. 6, during the period from 1982-91 the percentage of entry level practice jobs (by law firm size) for firms with 11 to 100 lawyers was 38.2%, which shrunk considerably to 22.5% for the duration 2002-2011.

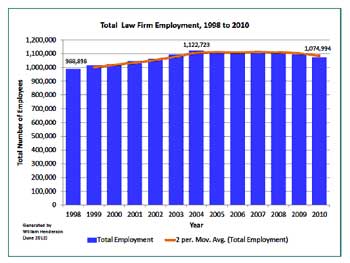

Once again, employment levels are following the trend displayed in figure 7. In 1998, the overall employment was at 988,898, which rose to 1,122,723 in 2004. This has come down to 1,074,994 in 2010.

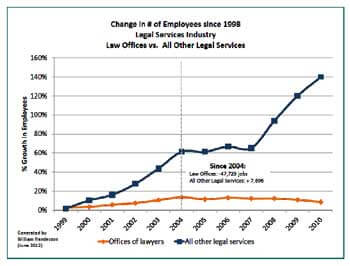

Once more, according to fig. 8, the percentage growth of lawyers peaked in 2004 and has been on a downward trend ever since.

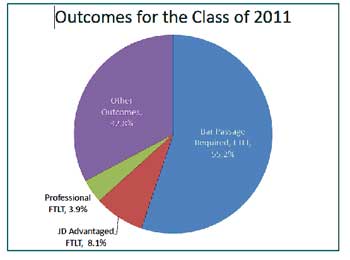

What can be considered even more damning, if not the final straw, is that slightly more than half of the class of 2011 (55%) found full-time, long term jobs that require bar passage nine months after they graduated.

According to the National Association of Law Placement (NALP), only two thirds of law graduates landed any type of job that required a law degree, and that the overall employment rate hit an 18-year low at 85.6%.

This only indicates that the coveted legal jobs are on the decline in the country. There needs to be convergence in thinking, implementation and accomplishment across the legal scenario in the United States. For those planning to pursue legal careers, perhaps a rethinking in their career strategy could help.

References:

http://www.law.com/jsp/nlj/PubArticleNLJ.jsp?id=1202559883779&ABA_Only_55_percent_of_law_grads_found_fulltime_law_jobs&slreturn=20120814092034

http://lawprofessors.typepad.com/legalwhiteboard/

http://www.rethinklaw.org/index.php/blog/from_the_experts_seize_the_day